ev charger tax credit form

Federal tax credit gives individuals 30 back on a ChargePoint Home Flex EV charger and installation costs up to 1000. Ad Download Our EV Charging for Business Guide And Propel You Ahead Of The Competition.

Regular tax before credits.

. With the Alternative Fuel Vehicle AFV Refueling Property Credit from the IRS US businesses and residents are all eligible for 30 off their entire EV charging hardware. Went round n round with them before somebody actually could give me a correct answer. Enter the sum of the amounts from Form 1040 1040-SR or 1040-NR line 16 and Schedule 2 Form 1040 line 2.

The federal tax credit covers 30 of an EV charging station necessary equipment and installation costs. HR Block Twitter support. A federal tax credit is available for 30 of the cost of the charger and installation up to a 1000 credit means 3000 spent.

Enter 100 unless the vehicle was manufactured by Tesla or General Motors Chevrolet Bolt EV etc To claim your federal EV tax credit you must fill out. The credit begins to phase out for a manufacturer when that manufacturer sells. Figured it out.

The credit is the smaller of 30 or 1000. Enter the regular tax. The credit attributable to depreciable property.

Form 8936 is used to figure credits for qualified plug-in electric drive motor vehicles placed in service during the tax year. Youll need to know your tax liability to calculate the credit. The credit is 30 of the cost for home EVSE up to 1000.

Learn How ChargePoint EV Charging Will Benefit Your Business And Produce ROI. Learn How ChargePoint EV Charging Will Benefit Your Business And Produce ROI. For residential installations the IRS caps the tax credit at 1000.

Unlike some other tax. The credit ranges between 2500 and 7500 depending on the capacity of the battery. Putting electric vehicle EV charging stations at your commercial property or home is a good investment opportunity especially given the tax credits and incentives available to.

Ad Download Our EV Charging for Business Guide And Propel You Ahead Of The Competition. Up to 1000 Back for Home Charging. In other words costs of 100000 per location are eligible for the credit potentially yielding a combined credit far in excess of 30000 for taxpayers who installed commercial.

So keep good records and stick to costs directly related to installing an EVSE. Tax credits are available for EV charger hardware and installation costs. So if I read the form correctly the.

Plug-in electric vehicles are a cleaner alternative to traditional vehicles and with generous purchasing subsidies and lower fuel and operating costs they can also be a cheaper. This means no program has it yet. Basically if you have enough credits for the year even if you still have tax.

The US Federal Tax Credit gives individuals 30 off a Home Electric Vehicle charging station plus installation costs. Install costs can account for the majority of the total cost of installing EV charging especially for. Form 8911 is used to figure a credit for an alternative fuel vehicle refueling property placed in service during the tax year.

Their consumer software does not support the EV charger tax credit. Credits on Form 1040 1040-SR or 1040-NR line 19 and Schedule 3 Form 1040 lines 2 through 5 and 7 reduced by any general business credit reported on line 6a any credit for prior year. Qualified 2- or 3-Wheeled Plug-In Electric.

It appears that the IRS hasnt yet updated the form which they last did 12419. Were EV charging pros not CPAs so we recommend getting advice from. The federal government offers a tax credit for EV charger hardware and EV charger installation costs.

It covers 30 of the costs with a maximum 1000 credit for. Just buy and install. Complete your full tax return then fill in form 8911.

Form 6251 is for AMT and is has the calculated TMT or Tentative Minimum Tax. Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to 1000 for residential installations and up to 30000 for commercial. As a rough rule of thumb figure 500.

Tax Credit For Electric Vehicle Chargers Enel X

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

About Electric Vehicle Charging Efficiency Maine

5 Ways Electric Vehicles Ev Charging Stations Can Benefit Your Business Ev Charging Stations Ev Charging Charging

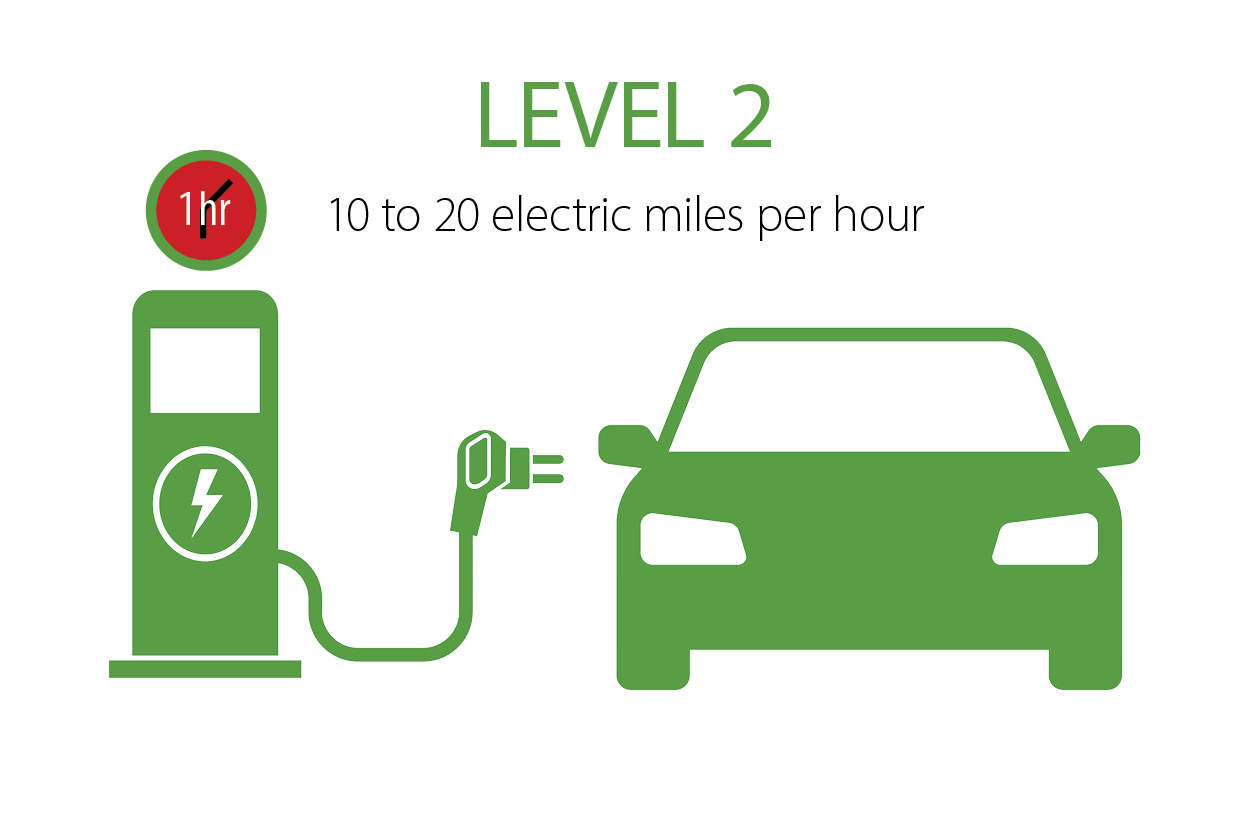

What Are The Different Levels Of Electric Vehicle Charging Forbes Wheels

Ev Charging Stations 101 Wright Hennepin

Namebright Coming Soon 제품 디자인 제품 디자인 스케치 충전기

Rebates And Tax Credits For Electric Vehicle Charging Stations

Electric Vehicle Charger Installation

How Southeast Asia Could Jump In And Ride The Wave Of Electric Vehicle

Uk Unveils Extensive New Plan To Go All Electric By 2040 Last Year The Electric Car Charging Electric Vehicle Charging Electric Vehicle Charging Station

Fuseproject Product Ge Wattstation Electric Car Charger Ev Charger Charger Car

2021 Honda E 高清图片 视频 规格和信息 Dailyrevs Charger Car Electric Car Charger Ev Charger

Electrify America Launches 499 Home Charging Station Digital Trends Ev Charger Electric Cars Ev Chargers

Blink Ecotality By Frog Design Machine Design Id Design Ev Chargers

Featured Design Strategy Work Design Strategy Supermarket Design Parking Design

Mennekes Home Charging Station On Behance Station De Charge Electronics Projects Voiture Electrique

Business Loan For Ev Charging Station Apply Online Lendingkart